IRS Jovem

What is «IRS Jovem» and to whom does it apply?

«IRS Jovem» is a tax regime created by the Portuguese 2020 State Budget which, through a partial Personal Income Tax (IRS) exemption aims to benefit, during three tax periods, young people who, after finishing their high school or college studies, enter the job market. This saving mechanism is directed to young professionals who, after concluding a cycle of studies, receive their first dependent work income in 2020 or in the following years.

Access Requirements

Access to this optional regime is required in the IRS annual return (model 3) and depends on the fulfillment of a series of requirements:

- Being between 18 and 26 years old;

- Not being considered “dependent” for tax purposes;

- Having concluded a studies degree corresponding to level 4 or higher of the National Qualification Framework, i.e. “high school diploma obtained through double certification courses or aimed at pursuing higher education studies plus a professional internship (minimum 6 months)”, “post-high school degree with credits for pursuance of college studies”, bachelor’s degree, master’s degree or Phd;

- Receiving taxable dependent work income (category A) equal or below the limit of the 4st IRS bracket, i.e. 25.075 euros (equivalent to an annual gross income of 29.179 euros).

Tax benefit

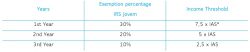

Thus, as long as the above conditions are met, young people will be able to benefit from a partial IRS exemption for three years, as follows:

*Under the terms of Decree No. 27/2020 of 31 January, the IAS for 2020 was set at 438.81 euros. In 2022, the value of the IAS was fixed at 443.20 euros according to Decree nº 294/2021 of 13 December.

However, it is important to highlight that each young person can only have access to this benefit once and that it is not cumulative with the Non-Habitual Residents program or with the “Programa Regressar” tax regime.

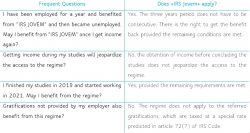

Below are some frequently asked questions about this subject.

What might change in 2022?

The Portuguese State Budget Proposal for 2022, presented by the Government, and voted down by the Parliament, included some changes regarding «IRS Jovem», namely the inclusion of independent work income and the extension of the tax benefit period from three to five years.

However, with the proposal being voted down, the changes which were expected to be one of the “flagship” measures of the State Budget did not entered into force, not letting other solution than to wait for eventual news that may come with the next Government.

At this point, it is clear that the job market is becoming increasingly competitive, desperately looking for human talent in the youngest generation who invest in their training. Hence, a more favourable tax regime as «IRS Jovem» may be seen as an incentive to the qualification of young people, supporting them in their adult life and in the labour market after finishing their studies.